17 August 2025

6 minutes read

How To Study Abroad After Chartered Accountant Degree: Scope And Opportunities?

Key Takeaways

- Study abroad after chartered accountant opens faster routes to CPA, ACCA, CFA, and MBA, giving a clear global edge over staying limited to Indian practice.

- Salaries for CAs abroad are 3–5 times higher than the average CA salary in India, with added career growth and leadership opportunities.

- Exemptions from international programs and credits for the three-year CA articleship make global degrees quicker and more efficient to complete.

When I look at the numbers, the reality is hard to ignore. Over 12,000 Chartered Accountants from India leave every year to work or study abroad. And I don’t blame them. After years of burning nights on CA Foundation, Intermediate and Final, too many CAs here end up overworked and underpaid. That’s the brutal truth nobody tells you during the course.

But outside India, it’s a different game. A CPA in the US earns close to 80,000 dollars a year, ACCA in the UK starts around 40,000 pounds, and CAs in the Middle East easily command tax free salaries. I’ve seen freshers double their income just by upgrading with the right international credential. That’s why I tell everyone, studying abroad after CA isn’t just an option anymore. It’s the smartest way to get best ROI.

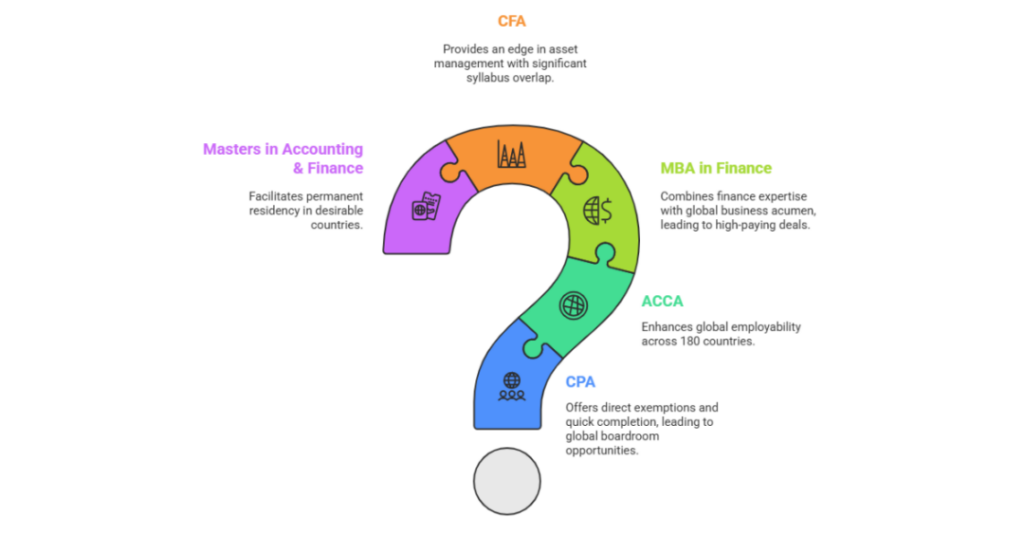

5 Best Degrees To Study Abroad After Chartered Accountant Course

The scope of CA in India is shrinking while global demand for finance talent is exploding (I will not get into details of “WHY”). The Big 4 alone hired over 80,000 accountants worldwide last year, but less than 6% of those hires were chartered accountants of India. Now what does that mean?

If you stay confined to domestic practice, you’re leaving serious work opportunities and high salary jobs on the table. If you’re smart enough to have cleared CA Foundation, CA Intermediate, and Final, you’re also smart enough to pivot. These degrees are the ones students must look at if they don’t want to watch their career peak too early.

1. Certified Public Accountants (CPA)

A CA from India can get direct exemptions and finish CPA in under 12 months. That’s why many students who once slogged years through the CA exam suddenly find themselves sitting in global boardrooms at Big 4 firms. Unlike the course for chartered accountants here, CPA is built for speed, not survival.

2. ACCA

While the chartered accountants in India are respected locally, ACCA makes you employable across 180 countries. Employers in Europe and the Middle East don’t even ask what professional course you cleared in India, they ask if you have ACCA. If you’re a CA fresher, this single credential can flip your CV from “local hire” to “global hire.”

3. MBA in Finance

Forget the outdated myth that MBAs are only for engineers. B-schools worldwide are chasing Indian Chartered Accountants because they bring technical finance expertise that others lack. Combine your chartered accounting background with a global MBA in top universities, and you’re not just doing compliance only, you’re negotiating billion-dollar deals. Data says MBA finance grads earn 2.5x more than a typical chartered accountant stuck in statutory audits. A friend of mine works in a Texas based small boutique investment firm. And you won’t believe if I even tell you how much he makes a year.

4. CFA

The scope and opportunities of CFA are clear: less than 10% of candidates clear all three levels. But, Indian CAs already understand 50% of the syllabus before even opening the first CFA book. That’s why global asset management firms prefer hiring a CA abroad with CFA over a plain MBA. For once, your CA course slog actually gives you an edge.

5. Masters in Accounting & Finance

Want permanent residency in Canada, Australia, or Singapore? A Master’s in Accounting or Finance is the cleanest ticket. Chartered accountants of India often underestimate this degree, but governments don’t. Immigration frameworks in these countries literally award extra points to applicants with recognized postgraduate finance qualifications.

What Are The Opportunities For CA In Abroad?

And nooo, I am not saying chartered accountancy doesn’t have enough value now. Not at all. Indian CAs have plenty of respect and recognition worldwide. But here’s the twist: the Institute of Chartered Accountants gave you a rock-solid foundation, and once you clear CA Final and officially become a Chartered Accountant, your career is just starting and not ending. Abroad, the playing field is much bigger, and most professionals don’t even realize the hidden doors open to them.

1. Global Recognition with Strategic Upgrades

The reality is simple. If you become a CA in India, you already tick half the boxes for global finance qualifications like CPA, ACCA, and CFA. What Indian CAs don’t always know is that many of these courses give exemptions because of the Institute of Chartered Accountants syllabus. That means you can complete them faster than a local graduate, giving you a head start in countries like the US, UK, and Canada.

2. Leadership Roles Beyond Accounting

Outside India, chartered accountancy is not boxed into audit or tax. Employers abroad expect CAs to step into CFO tracks, consulting, and financial strategy. A CA Final pass here has the potential to turn into a boardroom seat there. The difference is that global markets don’t see you as “just another accountant” but as someone capable of managing billion-dollar decisions.

3. Immigration and Residency Benefits

Here’s what many professionals miss: countries like Australia and Canada award immigration points to applicants with professional finance qualifications. An Indian CA with a postgraduate degree or aligned credential automatically ranks higher in their skilled migration system. Clearing CA Final is not just a professional win, it can be your ticket to long-term residency abroad.

4. Salary Multipliers Across Markets

Nobody tells you this in the Institute of Chartered Accountants coaching rooms, the same skill set earns drastically different pay abroad. A chartered accountancy background that earns ₹12–15 lakhs a year in India often earns four to five times more in developed markets. And it’s not only about money; it’s about faster growth, bigger networks, and the chance to influence at a global scale.

How To Apply To Top Universities In The World?

The first thing I’d tell you as a consultant is forget the fantasy that a shiny SOP alone gets you into a top university. Admissions teams see 50,000 applications a year; they can smell generic stories a mile away. What works is a strategy – knowing how to position your CA profile so it screams impact, global fit, and future potential.

Here’s the step-by-step playbook:

Step 1. Audit Your CA Profile Ruthlessly

Start with brutal honesty. Did you clear CA Final in multiple attempts or first shot? Did you complete the three-year CA articleship with solid accounting and auditing exposure, or did you just tick the hours? Universities love numbers, show cost savings, controls fixed, or clients handled. That’s what makes your chartered accountancy course work experience stand out.

Step 2. Match Country to Career, Not Prestige

Don’t chase rankings blindly. Match the scope of CA abroad with your own goals. For example, Canada and the USA are gold if you want to work as Certified Public Accountants or Chartered Professional Accountants. Singapore or the UK are better if you want consulting or MNC finance roles. Your target geography decides your degree, not the brand name alone.

Step 3. Secure Exemptions and Credits Early

Few Indian CAs know this: top universities and colleges to pursue CA abroad often give direct credits for your ICAI training. Some countries to pursue CA abroad will even fast-track you into a Master’s by acknowledging your three-year CA articleship training. That’s like skipping an entire semester if you plan it right.

Step 4. Build a Narrative Beyond Numbers

Here’s the twist — top schools don’t just want a calculator. They want leaders. Frame your journey not just as “I passed exams” but as someone who can sign as an independent CA, mentor teams, and create impact in chartered accounting firms. Mention how many chartered accountants from India hit a ceiling locally, and you’re pushing beyond. That’s credibility.

Step 5. Prove ROI With Hard Data

Admissions teams love clarity. Show them the average CA salary in India vs the global benchmarks for chartered accountants abroad. Prove that your career move isn’t a vanity project but an investment with real returns. This is where most applicants go soft, don’t.

Step 6. Apply Early and Network Smarter

Early applicants get noticed more. But don’t just click submit and pray. Join a CA chapter in your target country, reach out to alumni, and understand what chartered accounting firms are looking for when they hire a chartered accountant from India. When they vouch for you, your file stops being “just another CA from India” and becomes a real candidate.

Conclusion

In the end, the choice is simple- stay confined to statutory audits here, or join the network of many chartered accountants who turned their Indian CA credential into one of the best professional courses to work with the industries abroad. The ceiling is local, but the scope of chartered accountants is global.

The scope for CA doesn’t end the day you clear Final. It actually starts when you step outside the local bubble. The scope of CA in abroad is bigger, the opportunities for CA are wider, and the demand for chartered accountants abroad is sharper than what the average CA salary in India suggests. If you’ve managed to complete the three-year CA articleship training and can sign as an independent CA, you already have an edge that most graduates worldwide don’t.

Empower your professional journey by joining Ambitio Pro. Our holistic approach to career advancement offers a blend of personal development, skill-building, and strategic planning, ensuring you’re not just advancing in your career, but thriving.

FAQs

Can I pursue studies abroad after becoming a Chartered Accountant?

Yes, many CA professionals go abroad for advanced studies and global exposure.

Which countries are preferred for further studies after CA?

Popular choices include the USA, UK, Australia, Canada, New Zealand, Germany, and Malaysia.

What courses can I pursue abroad after completing CA?

Common options are CFA, CPA, MBA in Finance, and Law degrees.

Is ACCA recognized internationally like CA?

Yes, ACCA is a globally accepted qualification equivalent to CA in many regions.

What qualifications are needed to pursue CA or similar courses abroad?

Generally, completion of 12th grade and sometimes a bachelor’s degree in commerce or related fields.

You can study at top universities worldwide!

Get expert tips and tricks to get into top universities with a free expert session.

Book Your Free 30-Minute Session Now! Book a call now