25 August 2025

5 minutes read

Indian Platform to Have Affordable Loans for Studying Abroad: Education Loan for Students and Collateral

Key Takeaways

- Indian platform to have affordable loans for studying abroad offers flexible repayment terms and competitive interest rates.

- Indian platform to have affordable loans for studying abroad covers tuition fees, living expenses, and visa needs.

- Indian platform to have affordable loans for studying abroad ensures quick loan approval with collateral and unsecured options.

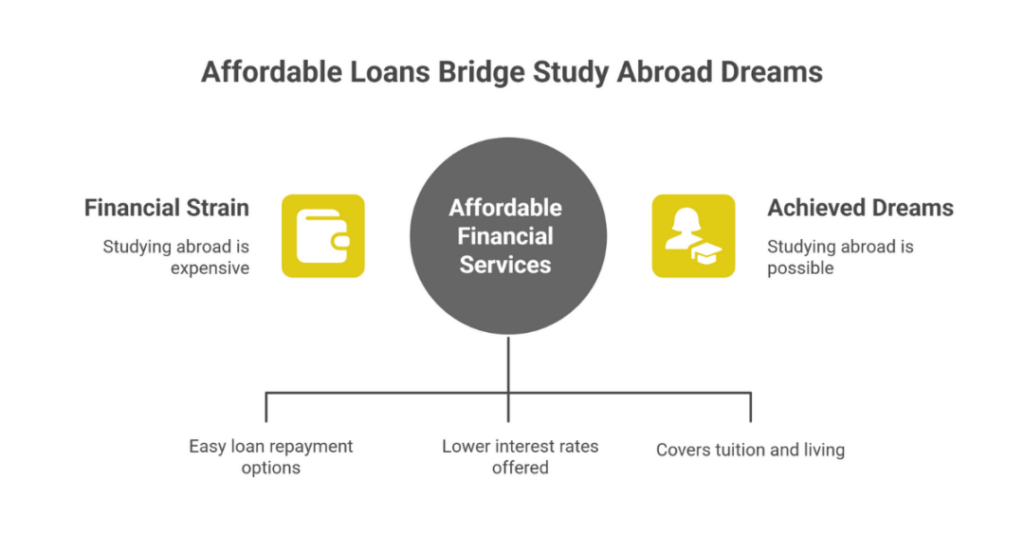

Studying abroad has become a dream for a lot of Indian students but can be financially straining. Fortunately, made in India affordable financial services can act as a bridge to these dreams by providing an education loan meant for studying abroad with flexible repayment, competitive interest rates, and financial backing for higher education abroad.

These student loans will cover tuition costs, budgets for living costs, and everything in between whenever they wish to pursue a professional course in their country or abroad.

Why Do Students Apply for Student Loan for Higher Education Abroad and Visa?

Did you know that almost 50% of Indian students go study overseas with the help of an education loan? Students apply for an education loan for foreign studies in order to fund their tuition fees, living expenses, and other visa requirements.

An education loan allows for smooth limited disbursing, gives the student financial backing, and allows for a more seamless higher education experience abroad.

How to Find the Best Indian Platform to Have Affordable Loans for Studying Abroad?

Fun fact: India is one of the fastest-growing foreign education loan markets due to the influx of demand for higher studies. Choosing the right platform is choosing one that is transparent, flexible on repayment, affordable on rate-of-interest.

Here are some tips of how students can secure financial support:

- Compares lending process: Evaluate lenders, alternative bank lenders, and bank loan / deposit options, using EMI-calculators.

- Check repayment: Look for flexible options for repayment, moratorium, and repayment structure of loan and EMI.

- Check eligibility criteria: Ensure that academic aspirations, GPA, transcript, and accompanying documentation i.e. aadhaar and mother & father in-law co-applicant details, meet requirements.

Comparison Table of Platforms

| Feature | Bank Education Loan | NBFC/Private Lender |

|---|---|---|

| Interest Rate | Competitive rate of interest usually 8-11% p.a. for education loan for study abroad | Loans may have higher rates of interest but provide greater flexibility |

| Collateral | Must provide collateral for sizeable loans amounting above ₹7.5 lakh | Many collateral free options available |

| Repayment Options | Very structured repayment term and degree of availability of flexibility while repaying loans | Some flexible degree of repayment terms and EMI-flexibility |

How to Apply for an Education Loan for Studying Abroad?

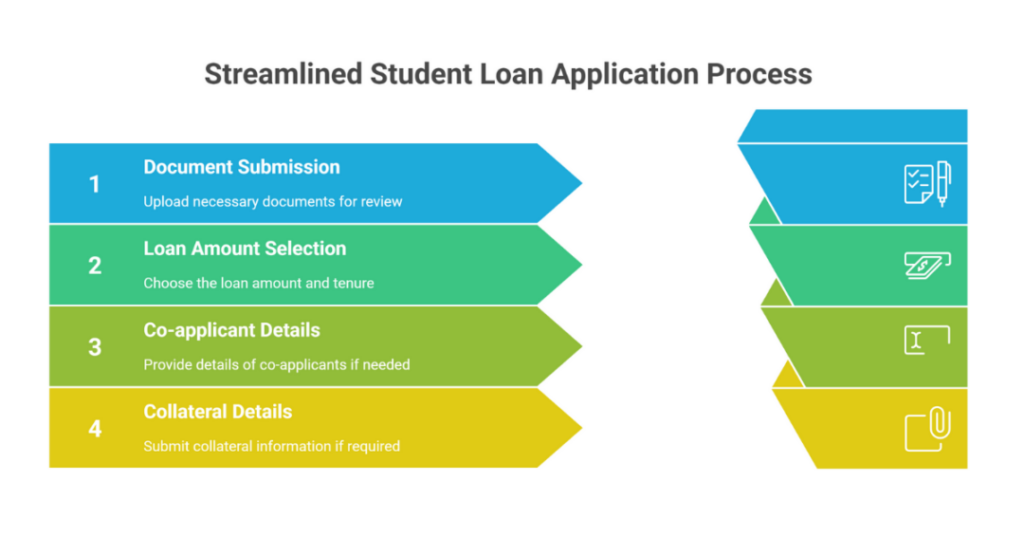

Fun fact – The process of applying for a student loan online via a bank website now takes less than 30 minutes. Since the loan application process requires documents to be submitted and a seamless loan application-process ensures sanction and timely disbursement – we will give you the steps to follow for a successful loan application.

Steps for applying for a loan:

- Commence the application-process: Apply for a student loan via the bank website or lender portal. Simply complete the form and attach documents including Aadhaar, Transcript, CV/Resume, Statement of Purpose, Personal Statement, and standardized test results, including ACT, IELTS, TOEFL, GRE, GMAT or SAT.

- Choose loan amount and loan tenure: Choose a loan value in context to tuition fees, living expenses, and whether any financial assistance is needed if you are studying full-time as an international student attending higher study abroad.

- Get loan approved and sanctioned: The bank will ask for co-applicant details and provide details of fixed deposits, margin money and collateral if seeking sizeable amounts. The sanction will commence after review and subsequent funds disbursement.

Comparison Table of Loan Application Types

| Criteria | Bank Application-Process | NBFC/Private Application-Process |

| Application Method | Online or physical branches | Online, so usually faster |

| Documents Required | GPA, transcripts, letter of recommendation, resume, details of co-applicants | More flexibility, less guidelines |

| Disbursal of Loan | After sanction, only for tuition fees | Usually quicker to disburse; simple interest from partial amount |

What is the Eligibility Criteria for Bank Education Loan for Abroad Studies?

Fun fact: Even details of parent in-law can sometimes be input as co-applicant information. Students looking for bank education loans to study abroad, must show proof of admission into a overseas study programs; have a respectable GPA; and provide transcripts, aadhaar, and completion of other bank processes to application.

Do Indian Banks Like SBI Sanction Education Loans Online?

Fun fact: SBI is one of the good Indian banks that provide education loans with flexible-repayment terms. Yes, SBI and banks like it do sanction education loans online and disburse the funds for tuition fees, as well as for living expenses and other overseas education needs, and all while being within the repayment framework.

Student Loan EMI Rates in India

Interesting note: The EMI that you pay on an education loan can be deducted under section 80E of the income tax act? EMI-rates for student loans in India are dependent on the lender, whether there are required collateral or not, and the type of security associated with the loan: unsecured and secured educational loan.

Comparison of Student Loan EMI-Rates in India

| Lender | Interest Rate (Per Annum) | Collateral | Tenure | EMI-Flexibility |

| SBI | 8.65% – 10.10% | Required for > ₹7.5 lakh | Up to 15 years | Flexible-repayment options |

| HDFC Credila | 9% – 12% | Without collateral possible | Up to 12 years | Flexible-repayment terms |

| IDFC Bank | 9% – 11.5% | Unsecured loans available | Up to 10 years | Moratorium and partial simple interest options |

The above interest rates allow student’s repayment flexibility for their higher studies abroad to remain financially reasonable. Each bank also provides EMI-calculators on their respective banks website for the applicant to calculate the repayment terms and determine their appropriate options.

Conclusion

In conclusion, obtaining a student loan in India is no longer a complicated or long-drawn-out process with numerous lenders, NBFC’s and private lending services providing better opportunities for financing students seeking overseas education.

With loan process secured against collateral and unsecured loans being made available, students can now obtain education loans with manageable interest rates being offered with flexible repayment options for higher study abroad opportunities, and very simple applications.

If you are looking for an expert lender, free counselling and initiation of your plan can be obtained through Ambitio, a consolidated platform that provides information on all areas related to overseas education.

FAQs

What is the best Indian platform to have affordable loans for studying abroad?

The best Indian platform to have affordable loans for studying abroad offers competitive interest rates, flexible repayment, and fast loan sanction through banks, NBFCs, or private lenders.

How can an Indian platform to have affordable loans for studying abroad help students?

An Indian platform to have affordable loans for studying abroad helps students by covering tuition fees, living expenses, and visa costs while ensuring smooth loan disbursement.

Does every Indian platform to have affordable loans for studying abroad require collateral?

Not every Indian platform to have affordable loans for studying abroad requires collateral, as unsecured loans are available with flexible repayment options.

Can Indian platform to have affordable loans for studying abroad support all courses?

Yes, an Indian platform to have affordable loans for studying abroad supports professional courses, full-time higher studies, and overseas education at top universities.

What is the typical interest rate on an Indian platform to have affordable loans for studying abroad?

The typical interest rate on an Indian platform to have affordable loans for studying abroad ranges from 8% to 12% per annum depending on lender and collateral.

How do students apply through an Indian platform to have affordable loans for studying abroad?

Students apply through an Indian platform to have affordable loans for studying abroad by submitting transcripts, Aadhaar, GPA, and test scores like IELTS, GRE, or GMAT online.

Why should students choose an Indian platform to have affordable loans for studying abroad?

Students should choose an Indian platform to have affordable loans for studying abroad because it ensures financial support, repayment flexibility, and stress-free academic aspirations overseas.

You can study at top universities worldwide!

Get expert tips and tricks to get into top universities with a free expert session.

Book Your Free 30-Minute Session Now! Book a call now