30 May 2025

6 minutes read

MS in Financial Engineering in USA for Indian Students

Key Takeaways

- MS in Financial Engineering in USA offers a blend of finance, mathematics, and programming to prepare students for high-demand quantitative careers.

- MS in Financial Engineering in USA provides access to top universities, industry connections, and internship opportunities on Wall Street and beyond.

- MS in Financial Engineering in USA equips students with advanced analytical skills to solve complex financial problems in global markets.

Financial engineering is changing at a highly speedy rate, and financial engineers are taking the key roles of developing new financial products, services, and approaches.

A Master of Science (MS) in Financial Engineering provides future financial engineers with quantitative knowledge, computational methods, and advanced skills to thrive in this highly dynamic field.

This in-depth exploration of the personality of financial engineering in the USA includes top programs, career prospects, and the unconventional mix of disciplines that characterizes this new innovation.

What is Financial Engineering in USA?

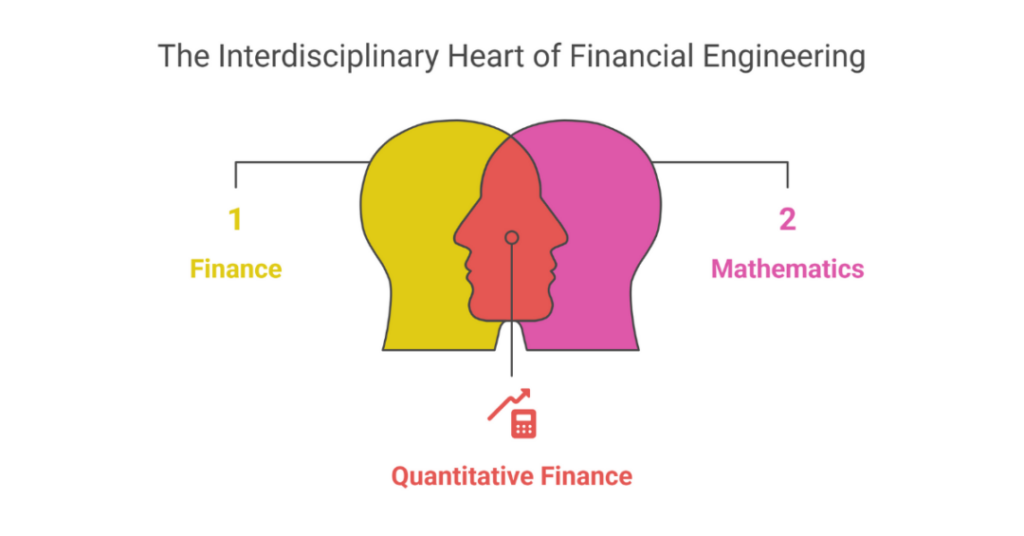

Financial engineering is a multidisciplinary area employing mathematical finance, computational algorithms, and economic theory in solving complex financial issues and creating novel financial products.

Financial engineering is a fusion of finance, mathematics, and computer science, that attempts to resolve financial problems and risk-management.

- Principal Disciplines: Quantitative and Computational Finance, Risk Management

- Applications: Development of financial products, Risk management policies, Algorithmic trading

Why Pursue a Masters in Financial Engineering in the USA?

The USA is blessed with a few of the world’s best financial engineering programs, with enhanced infrastructure, an active financial industry ecosystem, and access to the latest technology.

A Master of Science in Financial Engineering in the USA offers students:

- World-Class Education: These programs at Carnegie Mellon University and other top-tier institutions balance challenging academic coursework with hands-on, experiential learning.

- Industry Affiliations: Being in close proximity to important financial hubs like New York and San Francisco puts students in touch with the finance industry professionals and networks.

- Innovative Research: Exposure to advanced research facilities and inter-disciplinary cooperation in quantitative and financial technology.

Top US Universities for MS in Financial Engineering

The United States is world-famous for its world-class education in financial engineering and there are several of the world’s leading universities that offer Master of Science (MS) programs in the subject of innovation.

The schools offer a rigorous curriculum, high-quality faculty, and robust industry ties to get graduates ready to be in top form in the global finance sector. We consider here the best US universities for an MS in Financial Engineering, location, yearly fees, and unique features which distinguish one program from another.

| University | Location | Annual Fees | Highlighted Features |

|---|---|---|---|

| Carnegie Mellon University | Pittsburgh, PA | $65,000 | Leader in computational finance, strong industry ties |

| Columbia University | New York, NY | $74,000 | Focus on financial-markets, risk management, and fintech |

| New York University (NYU) | New York, NY | $60,000 | Excellence in quantitative finance, financial technology |

| University of California, Berkeley | Berkeley, CA | $68,000 | Innovative curriculum in financial engineering, strong quantitative finance focus |

| Massachusetts Institute of Technology (MIT) | Cambridge, MA | $77,000 | Cutting-edge research in financial mathematics and computational finance |

| University of Chicago | Chicago, IL | $72,000 | Known for financial economics and quantitative finance research |

| Cornell University | Ithaca, NY | $69,000 | Comprehensive program with a focus on financial theory and applications |

| Princeton University | Princeton, NJ | $75,000 | Strong emphasis on stochastic modeling and risk management |

| University of Southern California (USC) | Los Angeles, CA | $61,000 | Focuses on both financial engineering and business analytics |

| Stanford University | Stanford, CA | $80,000 | Interdisciplinary approach combining finance, mathematics, and computational techniques |

| Baruch College, City University of New York | New York, NY | $35,000 | Affordable program with strong ties to the financial industry |

| Georgia Institute of Technology | Atlanta, GA | $55,000 | Emphasis on computational finance and quantitative risk analysis |

| University of Michigan, Ann Arbor | Ann Arbor, MI | $65,000 | Focuses on financial data analytics and risk management |

| Boston University | Boston, MA | $70,000 | Focus on global financial-markets and quantitative finance |

| University of Illinois Urbana-Champaign | Urbana-Champaign, IL | $58,000 | Strong curriculum in financial engineering and applied mathematics |

Did You Know?

The Master of Science in Financial Engineering program at Carnegie Mellon University is recognized for its strong industry ties and leadership in computational finance, with annual tuition fees around $65,000.

Curriculum and Specializations to Study MS in US

The curriculum of an MS in Financial Engineering program is meticulously designed to blend quantitative finance, computational skills, and practical application in the financial industry.

This section delves into the core courses and specializations available within these programs, offering students a pathway to mastering the skills necessary for tackling today’s financial challenges.

| Core Courses | Specializations | Description |

|---|---|---|

| Quantitative Methods in Finance | Quantitative Finance | Mathematical and statistical models for financial decision-making |

| Stochastic Calculus for Finance | Computational Finance | Development and implementation of algorithms to solve financial problems |

| Computational Methods in Finance | Risk Management | Identifying, analyzing, and mitigating financial risk |

| Financial Risk Management | Financial Technology | Leveraging technology to innovate financial products and services |

| Financial Markets and Products | Applied Financial Mathematics | Applying mathematical concepts to practical financial engineering problems |

Adapting to the Financial Landscape: Skills for Tomorrow While Studying Financial Engineering

The rapidly evolving field of financial engineering demands a unique set of skills to navigate the challenges and leverage the opportunities it presents.

As financial markets grow more complex and integrated with technology, financial engineers must develop a blend of technical, analytical, and soft skills to excel. Here’s how aspiring financial engineers can adapt to the financial landscape and prepare for the future:

Financial engineering is about the application of mathematical methods to the solution of problems in finance.

– Paul Wilmott

- Quantitative and Computational Proficiency: Mastery in quantitative finance, computational finance, and applied financial mathematics is essential. Financial engineers should be adept at using mathematical models and computational algorithms to analyze financial markets, manage financial risks, and develop new financial products.

- Understanding of Financial Markets and Instruments: A deep understanding of financial markets, financial instruments, and financial services is crucial. This includes knowledge of the workings of global financial markets, the characteristics of various financial products, and the dynamics of financial institutions.

- Risk Management Expertise: With the growing complexity of financial products and markets, expertise in financial risk management is more important than ever. Financial engineers need to be equipped with strategies and tools to identify, assess, and mitigate financial risks.

- Technological Savvy: The integration of financial technology (fintech) into traditional finance has opened new avenues for innovation. Skills in financial IT, algorithmic trading, and the application of financial analytics are vital for developing and implementing technology-driven financial solutions.

- Adaptability to Financial Regulations: Understanding the regulatory environment and compliance issues is essential. Financial engineers must navigate the financial landscape within the bounds of financial law, ensuring that new financial products and strategies are compliant with current regulations.

- Critical Thinking and Problem-Solving: The ability to analyze complex financial and global systems, identify problems, and devise innovative solutions is key. Financial engineers should possess strong analytical skills and a creative approach to solving financial problems.

- Communication and Teamwork: Effective communication and teamwork skills are critical for financial engineers, who often work in multidisciplinary teams. The ability to articulate complex financial concepts to non-specialists and collaborate effectively is essential for success in this field.

- Ethical Consideration and Social Responsibility: As financial engineers develop new financial products and strategies, ethical considerations and social responsibility should guide their work. Understanding the impact of financial engineering on society and committing to ethical practices is crucial.

- Continuous Learning and Professional Development: The field of financial engineering is continuously evolving with advancements in technology and changes in financial markets. Financial engineers must commit to lifelong learning, staying abreast of the latest developments in quantitative finance, computational tools, and financial regulations.

The best financial engineers have a deep understanding of the types of problems that can be addressed with quantitative tools.

– John C. Hull

Financial Considerations and Scholarships

Pursuing an MS in Financial Engineering is a significant investment in one’s future. Understanding the financial aspects, including tuition fees and available scholarships, is crucial for prospective students.

This section provides detailed information on the financial considerations associated with pursuing an MS in Financial Engineering in the USA.

| University | Scholarship Name | Amount/Description |

|---|---|---|

| Carnegie Mellon University | CMU Financial Engineering Scholarship | Varies; based on merit and need, covers partial to full tuition |

| Columbia University | Columbia FE Fellowship | Partial tuition; awarded based on academic excellence and leadership |

| New York University | NYU Tandon Scholarship | Up to $25,000; based on merit, for outstanding applicants |

| University of California, Berkeley | Berkeley MFE Fellowship | Varies; for exceptional candidates, based on academic and professional merit |

| Massachusetts Institute of Technology | MIT Quant Finance Fellowship | Partial tuition; for students showing exceptional promise in quant finance |

Career Opportunities for Financial Engineers

The evolving landscape of the finance industry opens a myriad of career opportunities for financial engineers.

With their unique skill set combining quantitative analysis, computational finance, and financial theory, graduates are highly sought after in various sectors such as banking, hedge funds, technology, and financial services.

| Position | Industry/Sector | Description |

|---|---|---|

| Quantitative Analyst | Banking, Hedge Funds | Develops quantitative models to maximize profits and reduce risk |

| Risk Manager | Financial Services | Identifies and analyzes risks to minimize losses |

| Financial Software Engineer | Technology, Finance | Designs and implements financial software solutions |

| Algorithmic Trader | Trading Firms | Uses algorithms to automate trading strategies |

| Data Scientist | Finance, Technology | Analyzes financial data for insights and decision-making |

Conclusion

An MS in Financial Engineering offers a gateway to a rewarding career at the intersection of finance, mathematics, and technology.

With the right preparation, program selection, and commitment to continuous learning, graduates can play a pivotal role in shaping the future of the financial industry.

Define industry excellence with Ambitio Pro as your partner. Our commitment to your growth is reflected in our tailored programs, expert-led training, and a community that inspires and challenges you to set new standards in your professional life.

FAQs

What is an MS in Financial Engineering in USA and why pursue it?

An MS in Financial Engineering in USA is a specialized degree combining finance, math, and coding, and pursuing an MS in Financial Engineering in USA opens doors to top-tier quantitative careers.

Which universities offer the best MS in Financial Engineering in USA?

Leading institutions for MS in Financial Engineering in USA include Columbia, UC Berkeley, and NYU; these schools offer highly ranked MS in Financial Engineering in USA programs with industry ties.

What are the eligibility criteria for MS in Financial Engineering in USA?

Eligibility for MS in Financial Engineering in USA typically includes a strong background in math, programming, a relevant undergraduate degree, and standardized test scores like GRE or GMAT.

Is work experience required for MS in Financial Engineering in USA?

While not always mandatory, work or internship experience in finance or tech can strengthen your application for an MS in Financial Engineering in USA.

What are the career prospects after MS in Financial Engineering in USA?

Graduates of MS in Financial Engineering in USA pursue careers in investment banking, quantitative analysis, risk management, and fintech firms.

How much does it cost to study MS in Financial Engineering in USA?

The cost of MS in Financial Engineering in USA ranges from $50,000 to $90,000 depending on the university, excluding living and personal expenses.

Is GRE required for MS in Financial Engineering in USA?

Most universities require the GRE for MS in Financial Engineering in USA, though some may waive it based on academic or professional credentials.

You can study at top universities worldwide!

Get expert tips and tricks to get into top universities with a free expert session.

Book Your Free 30-Minute Session Now! Book a call now